Step-by-Step Enquiry Process

Finance Comparison Table

FAQs

Who do you provide finance to?

A range of finance options is provided to Limited companies

How does VAT work?

Hire Purchase (HP)

You can either:

- Pay VAT upfront as a deposit.

- Defer VAT for up to 3 months.

Finance Lease

VAT is included in your monthly payments.

How do I apply?

You can apply by completing the finance request from.

How long does approval take?

Approval typically takes between 1 hour and 24 hours.

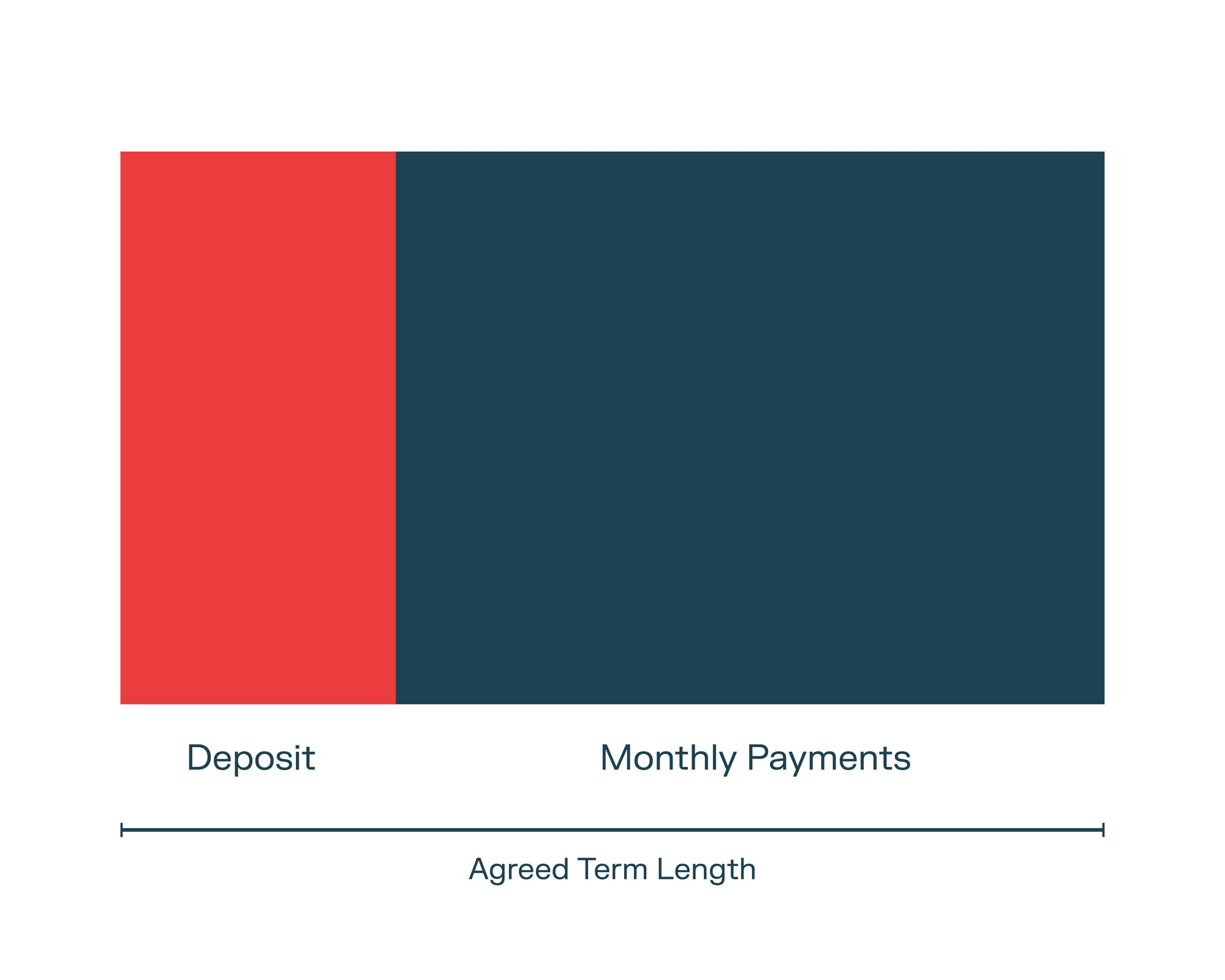

Do I need to pay a deposit?

It depends on your business's financial health. Strong businesses may not need a deposit, but newer businesses or those with adverse credit likely will.

Can I get vehicle finance with poor credit?

Yes, we work with funders who support businesses with poor credit or those just starting out.

Can I get vehicle finance as a new business?

Yes, we work with funders who support businesses who are just starting out.

Is finance provided by CPD Finance?

We're a credit broker, not a lender. We work with One Funding t/a CPD Finance and their panel of lenders and finance products.