CPD Insight: What the Latest Van Market Trends Mean

The latest figures from the Society of Motor Manufacturers and Traders (SMMT) show that light commercial vehicle (LCV) registrations fell by 14.8% in June 2025, marking the seventh month of quieter activity across the UK van market. But while national sales are down, the need for well-equipped, reliable commercial vehicles hasn’t gone away. In fact, now may be a smart time for businesses to review their fleet strategy and take advantage of vehicle availability, finance options, and tailored support from trusted partners like CPD.

The Latest Market Snapshot

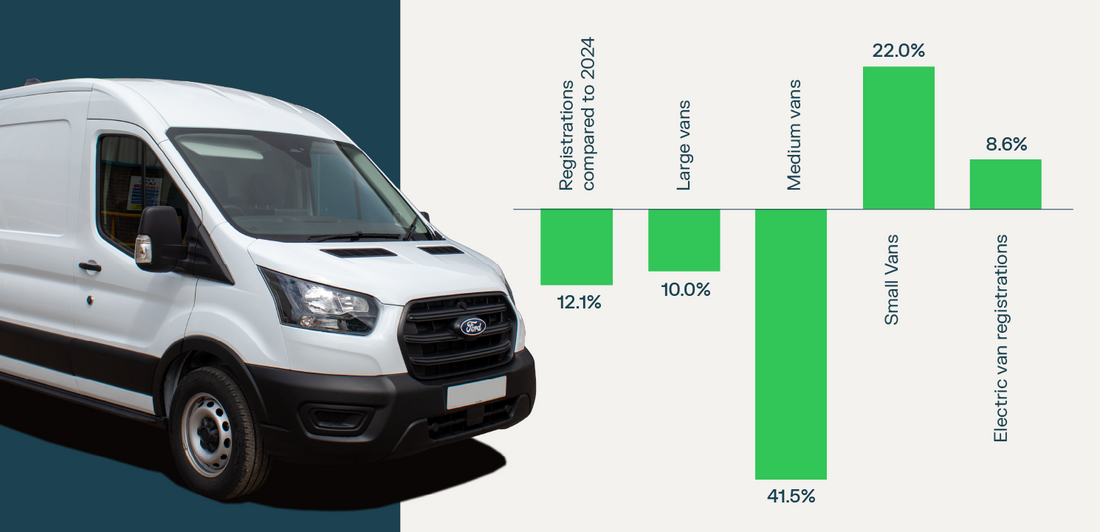

- 28,173 new vans were registered in June

- Year-to-date total: 156,048 registrations – down 12.1% compared to 2024

- Large vans (2.5–3.5t): down 10.0%

- Medium vans (2.0–2.5t): down 41.5%

- Small vans (<2.0t): up 22.0%

- Pick-ups: down for the second month following tax changes

- Electric vans: registrations almost doubled in June, now making up 8.6% of the market

Why We’re Seeing a Slower Start to 2025

There’s no doubt that higher costs and changing tax rules have made some businesses more cautious. However, this is creating an opportunity for those ready to invest in fit-for-purpose vehicles that support growth and efficiency. Key factors behind the slowdown include:

- Economic uncertainty causing delayed decisions

- Tax changes affecting demand for double-cab pick-ups

- EV adoption still being limited by infrastructure gaps and grid access

While these are real challenges, they’re also short-term. Many operators are already planning ahead to avoid disruption later.

Looking Ahead

With registrations down 14.8% in June and 12.1% year-to-date, it’s clear many businesses are holding off on new vehicle investment, a trend that could cause rising repair costs, compliance issues with ageing vans, and a long wait for supply when demand returns. A phased renewal strategy now offers better control, wider choice, and avoids disruption later on.

Positive Signs: EV Growth and Expanding Model Choice

Electric van registrations are up 52.8% year to date, with nearly 40 battery electric models now available in the UK. Manufacturers continue to invest heavily in the sector, and many businesses are beginning to integrate EVs into parts of their fleet, especially for local work. The electric market is moving, and CPD is ready to support the transition.

Tom Pearson, Commercial Director at CPD added:

“The national figures show a slowdown, but that doesn’t mean standing still. We’re actively working with customers who want to take control of their fleet strategy, whether that’s reducing downtime, improving efficiency, or preparing for future compliance. Fleet renewal doesn’t have to be all at once. We’re helping businesses make smart, staged decisions; replacing high-mileage vehicles, introducing EVs where they make sense, and reviewing finance options to manage budgets more effectively. Because we plan ahead, hold stock, convert in-house, and support the full range of vehicle types, including electric, we’re not just reacting to the market. We’re giving our customers the tools to stay ahead of it.”

How CPD Supports Smarter Fleet Decisions

- Stock available now across popular base vehicles

- Flexible build slots to meet operational timelines

- EV-ready conversions with infrastructure advice

- Support with EV grants and eligibility

- Flexible finance options to help manage budgets

- Full product range support – CPD is type approved across all major manufacturers, including electric chassis

- Proven EV expertise – we’ve been converting electric vehicles since 2018, giving us a long-standing track record in the space

- Sector-specific advice – trusted by trades, local authorities, utilities, and fleet operators nationwide

Summary

The market may be facing a slower patch, but smart planning and the right partner make a real difference. Whether you’re looking to replace one vehicle or shape your longer-term fleet strategy, CPD is ready to support you with stock, capability, and confidence.

Reference: SMMT data published July 2025. https://www.smmt.co.uk/van-market-shrinks-every-month-in-first-half-of-2025/